Understanding BVN Check: A Comprehensive Guide

In the digital age, the importance of a Bank Verification Number (BVN) cannot be overstated, especially in Nigeria. The BVN check is an essential tool for ensuring secure banking transactions and preventing fraud. This article will explore everything you need to know about BVN checks, their significance, and how to conduct one effectively.

The BVN, introduced by the Central Bank of Nigeria (CBN) in 2014, serves as a unique identifier for bank customers. It links all the accounts held by an individual across various banks in Nigeria, thus enhancing the security of banking operations. In this guide, we will delve into the details of how BVN checks work, the procedures involved, and their relevance in today's financial landscape.

As we navigate through this article, you will gain valuable insights into the BVN check process, including its benefits, drawbacks, and how it impacts your financial activities. Whether you are a bank customer or a financial service provider, understanding BVN checks is crucial for safeguarding your financial interests.

Table of Contents

- What is BVN?

- Importance of BVN Check

- How to Check BVN

- BVN Check via USSD

- BVN Check Online

- Common Issues and Solutions

- Data Privacy and Security

- Conclusion

What is BVN?

The Bank Verification Number (BVN) is an 11-digit unique identification number issued to every bank customer in Nigeria. It serves as a means of identifying and verifying customers of banks in Nigeria. The BVN is linked to all the bank accounts owned by a customer, providing a secure way to manage multiple accounts and transactions.

Here are some key points about BVN:

- Introduced by the Central Bank of Nigeria in 2014.

- Mandatory for all bank customers in Nigeria.

- Helps in reducing banking fraud and identity theft.

- Facilitates easy access to banking services.

Importance of BVN Check

The BVN check plays a critical role in the banking ecosystem. Here are some reasons why conducting a BVN check is essential:

- Fraud Prevention: BVN checks help banks verify the identity of customers, reducing the risk of fraud.

- Loan Approval: Financial institutions often require a BVN check before approving loans to assess creditworthiness.

- Account Linking: BVN allows for the linking of multiple accounts, making it easier for customers to manage their finances.

- Regulatory Compliance: Banks are required to comply with regulatory standards, and BVN checks help ensure adherence to these regulations.

How to Check BVN

Checking your BVN is a straightforward process. Here are the steps to follow:

- Visit the official website of your bank.

- Locate the BVN check section.

- Enter the required details, such as your account number and personal information.

- Submit the information to view your BVN.

BVN Check via SMS

In addition to online checking, you can also conduct a BVN check via SMS. Most banks provide an SMS service where you can send your request to a designated number to receive your BVN.

BVN Check through Customer Service

If you encounter difficulties checking your BVN online or via SMS, you can contact your bank's customer service for assistance. They can guide you through the process and help resolve any issues.

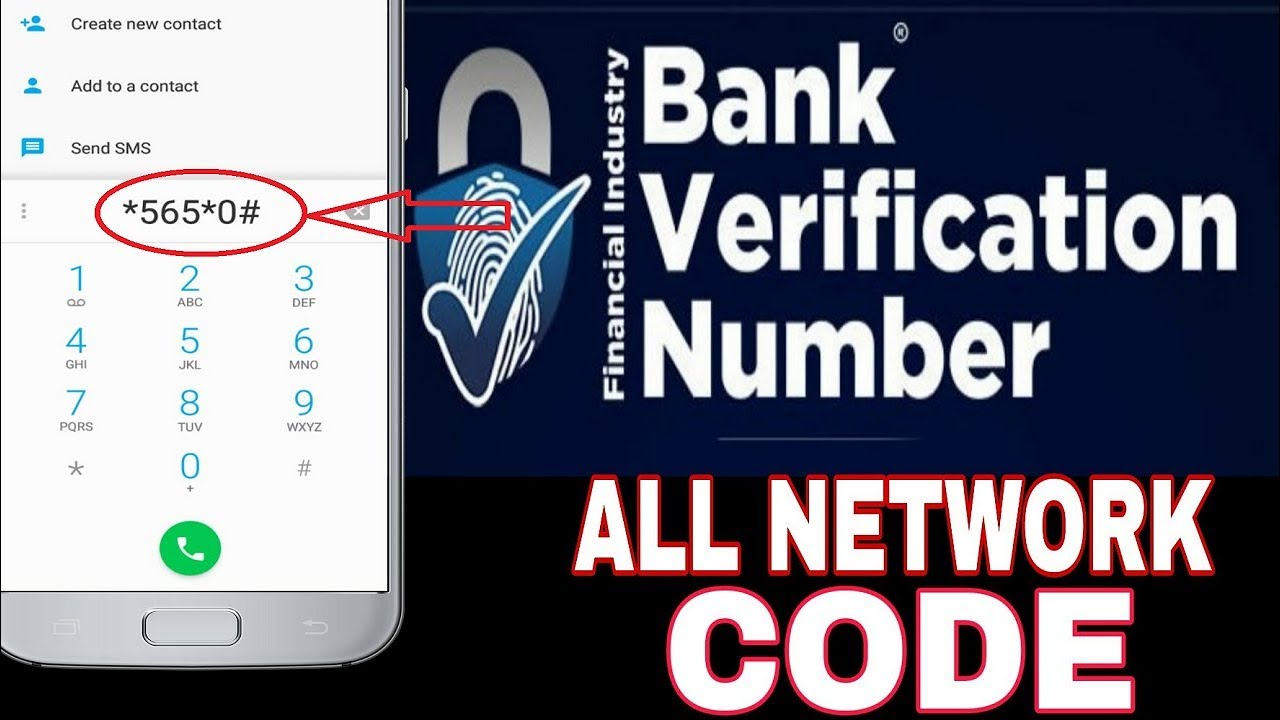

BVN Check via USSD

USSD (Unstructured Supplementary Service Data) allows customers to check their BVN without needing internet access. Here’s how to check your BVN using USSD:

- Dial the USSD code provided by your bank.

- Follow the prompts to enter your account details.

- Your BVN will be displayed on your screen.

This method is particularly useful for customers in areas with limited internet connectivity.

BVN Check Online

With the advancement of technology, checking your BVN online has become easier. Most banks offer an online platform where customers can securely log in to view their BVN. Here are the steps:

- Visit your bank's official website.

- Navigate to the BVN section.

- Log in with your account details.

- Access your BVN information securely.

Common Issues and Solutions

While checking your BVN is generally straightforward, you may encounter some common issues. Here are a few problems and their solutions:

- Invalid Account Details: Ensure that you are entering the correct account number and personal information.

- Network Issues: If you experience connectivity issues, try again later or use an alternative method (e.g., USSD).

- Technical Errors: Contact your bank’s customer service for assistance with technical problems on their platform.

Data Privacy and Security

As with any online process, data privacy and security are paramount when conducting a BVN check. Here are some tips to ensure your information remains secure:

- Always use official bank websites or apps for BVN checks.

- Do not share your BVN or personal information with unverified sources.

- Regularly monitor your bank accounts for any suspicious activities.

Conclusion

In conclusion, a BVN check is an essential aspect of banking in Nigeria, enhancing security and convenience for customers. By understanding the importance of BVN checks, how to conduct them, and the potential issues that may arise, you can better manage your financial activities. Always prioritize your data privacy and security when engaging in any banking transactions.

We encourage you to share your thoughts in the comments below, and if you found this article helpful, feel free to share it with others. For more information on financial topics, explore our other articles.

Thank you for reading, and we look forward to welcoming you back for more insightful content!

Exploring Queen Blackwell: The Rising Star Of Social Media

All About Ronaldo's Family: A Deep Dive Into The Lives Of The Iconic Footballer’s Loved Ones

Creating The Ultimate Depressed Playlist: Music To Heal Your Soul